Invoicing is often a bottleneck—manual steps, late payments, and client disputes slow down your cash flow. Minasoft Invoicing eliminates the chaos with a powerful yet user-friendly system that automates billing from end to end.

From sale to payment—simplified, secured, and streamlined.

What Invoicing can do for you?

Convert quotes and orders into invoices in seconds, schedule recurring invoices, and enable online payments with instant reconciliation. Whether you're billing for products, services, or subscriptions, the module ensures precision, transparency, and faster revenue recognition.

Automated Invoicing and Payment Tracking

The power of Minasoft Invoicing lies in its ability to automate repetitive billing tasks without compromising control. Define rules for recurring invoices, partial payments, and advance billing.

Forget spreadsheets, missed follow-ups, and manual PDF creation. With Minasoft Invoicing, every step—invoice creation, delivery, tracking, and payment—is integrated into one seamless flow.

Smart Reconciliation and Real-Time Tracking

Set payment terms and let the system handle reminders. With every invoice tracked in real time, and payments matched automatically, you gain full command over your cash flow.

Recurring Billing

Set, forget, and invoice on schedule

Payment Status

Track when invoices are opened, viewed, and paid

Auto-Match

Auto-match payments with invoices

Flexible Invoice Generation

Generate invoices manually, from sales orders, timesheets, or recurring contracts. Minasoft adapts to your business model—whether you sell products, bill by hour, or operate under long-term service agreements.

- Create one-off, recurring, or milestone-based invoices

- Integrate with timesheets, projects, or field services

- Customize invoice layouts with templates

- Batch-generate and send multiple invoices at once

Customer Payment Portal

Enhance customer experience and reduce friction with a branded payment portal. Clients can view, download, and pay invoices online using their preferred payment method.

- Secure customer portal with real-time updates

- Accept multiple payment methods and currencies

- Reduce support requests with self-service tools

- Track customer invoice views and payment attempts

Simplify your billing. Accelerate your cash flow.

Switch to smarter invoicing with Minasoft and get paid faster, with less effort.

Request Your Free DemoWill I be able to automate all my invoicing tasks?

Yes. From generating recurring invoices to sending follow-ups and collecting payments, Minasoft Invoicing automates nearly every step of the billing process. You define the rules, and the system ensures they're executed—saving your team hours every week.

What if I offer both products and services?

No problem. You can invoice product deliveries, consulting hours, maintenance plans, or subscriptions—all from the same interface. The module supports flexible billing scenarios and automatically pulls data from connected modules like Sales, Projects, or Field Services.

Will my customers be able to pay online?

Yes. You can enable online payments through trusted gateways like Stripe, PayPal, or local providers. Invoices include payment links and are accessible through a secure portal, making the payment process fast and frictionless for your clients.

Can I use my own invoice layout and branding?

Absolutely. Create branded invoice templates with your logo, colors, legal terms, and footer notes. Customize by company, region, or customer segment. You maintain a professional image while staying compliant.

How will I track overdue invoices?

Minasoft provides real-time dashboards and detailed aging reports. You'll know which invoices are due, how late they are, and who's responsible. Combine that with automated reminders and your collection process becomes systematic and effective.

Can my team control which invoices get approved?

Yes. You can define workflows for invoice validation, requiring approval before confirmation or sending. This ensures that sensitive billing cases or high-value customers are always reviewed before going out.

What happens if a customer overpays or pays in part?

Minasoft handles it smoothly. Partial payments are tracked and matched to the correct invoice. Overpayments can be applied as credits to future invoices, refunded, or left on account—whichever you prefer.

Will this system integrate with my accounting and sales?

Seamlessly. Every invoice feeds directly into Accounting, and most are generated from Sales, Projects, or Timesheets. There's no need to copy data or reconcile manually—it's all connected by design.

Can I migrate my existing invoices into the system?

Yes. You can import historical invoices, open receivables, and payment records. Our tools and team support structured imports, so you start with your full billing history intact.

How do automated reminders work?

Configure multi-step follow-up workflows and personalize reminder templates by customer segment. The system automatically escalates from gentle nudges to firm notices based on invoice age and customer history.

What payment methods are supported?

Connect to multiple payment gateways including Stripe, PayPal, Adyen, and others. Clients can pay using credit cards, debit cards, bank transfers, or online wallets directly from the invoice or customer portal.

How does payment reconciliation work?

Incoming payments from gateways or bank syncs are automatically matched with open invoices. The system supports partial matches, credit notes, and overpayments—minimizing manual work and ensuring accuracy.

Is this system compliant with my country's tax laws?

Yes. The module supports country-specific invoice layouts, taxes, and fiscal fields. Electronic invoice formats (like CFDI in Mexico or NF-e in Brazil) are available through integrations or localization packs.

Can I invoice in multiple currencies?

Absolutely. Issue invoices in any currency with automatic conversion to your accounting base currency. Exchange rates are updated in real time, and financial reports show both original and converted values.

What about electronic invoicing requirements?

Generate e-invoices in formats accepted by public authorities. Integrate QR codes, XML tags, and electronic signatures for jurisdictions with e-invoicing mandates, ensuring full compliance.

How is invoice data stored and secured?

Each invoice is stored with metadata, history of changes, and a permanent audit trail. Comply with tax authority retention rules and always be prepared for external audits or internal controls with secure archiving.

General Questions

Find answers to the most common questions about Minasoft Invoicing and how it can streamline your billing processes.

Will I be able to automate all my invoicing tasks?

Yes. From generating recurring invoices to sending follow-ups and collecting payments, Minasoft Invoicing automates nearly every step of the billing process. You define the rules, and the system ensures they're executed—saving your team hours every week.

What if I offer both products and services?

No problem. You can invoice product deliveries, consulting hours, maintenance plans, or subscriptions—all from the same interface. The module supports flexible billing scenarios and automatically pulls data from connected modules like Sales, Projects, or Field Services.

Will my customers be able to pay online?

Yes. You can enable online payments through trusted gateways like Stripe, PayPal, or local providers. Invoices include payment links and are accessible through a secure portal, making the payment process fast and frictionless for your clients.

Can I use my own invoice layout and branding?

Absolutely. Create branded invoice templates with your logo, colors, legal terms, and footer notes. Customize by company, region, or customer segment. You maintain a professional image while staying compliant.

How will I track overdue invoices?

Minasoft provides real-time dashboards and detailed aging reports. You'll know which invoices are due, how late they are, and who's responsible. Combine that with automated reminders and your collection process becomes systematic and effective.

Is this system compliant with my country's tax laws?

Yes. The module supports country-specific invoice layouts, taxes, and fiscal fields. Electronic invoice formats (like CFDI in Mexico or NF-e in Brazil) are available through integrations or localization packs.

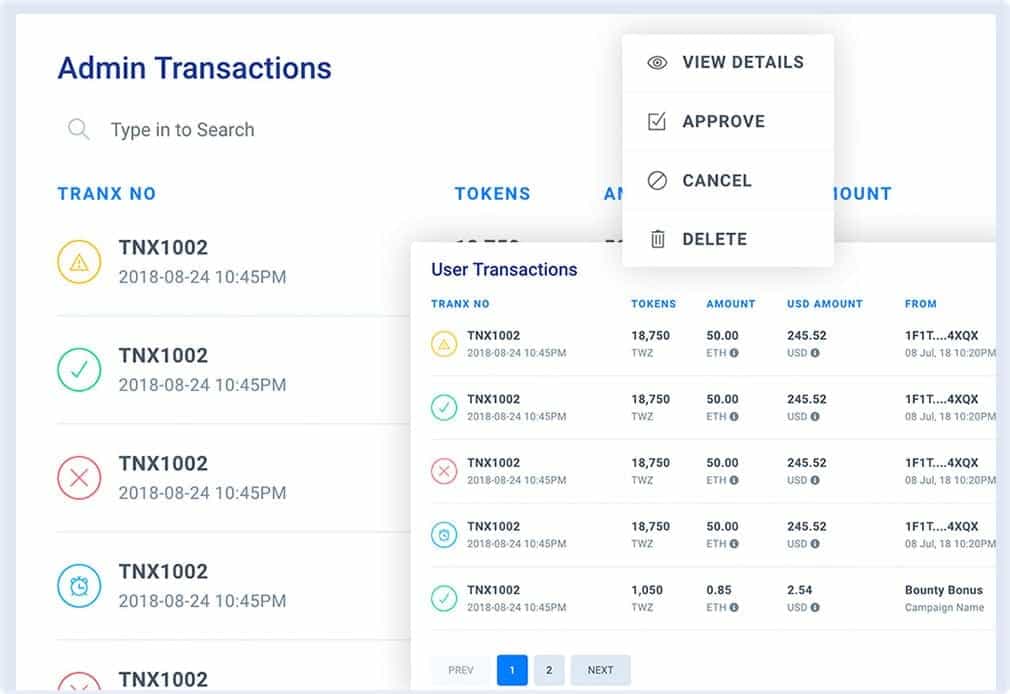

Can my team control which invoices get approved?

Yes. You can define workflows for invoice validation, requiring approval before confirmation or sending. This ensures that sensitive billing cases or high-value customers are always reviewed before going out.

What happens if a customer overpays or pays in part?

Minasoft handles it smoothly. Partial payments are tracked and matched to the correct invoice. Overpayments can be applied as credits to future invoices, refunded, or left on account—whichever you prefer.

Will this system integrate with my accounting and sales?

Seamlessly. Every invoice feeds directly into Accounting, and most are generated from Sales, Projects, or Timesheets. There's no need to copy data or reconcile manually—it's all connected by design.

Can I migrate my existing invoices into the system?

Yes. You can import historical invoices, open receivables, and payment records. Our tools and team support structured imports, so you start with your full billing history intact.

Industries We Serve

Minasoft Invoicing adapts to your industry's unique billing requirements and workflows.

SaaS & Technology

Subscription models and usage-based billing are the backbone of SaaS businesses. Minasoft Invoicing automates recurring invoicing, handles trial-to-paid conversions, and supports multiple payment methods. With full API integration and client self-service portals, your billing operations become as scalable as your software.

Professional Services

Consulting firms, agencies, and freelancers need to bill by time, milestones, or retainer. Minasoft links time-tracking and project delivery directly to invoicing, ensuring every billable hour is accounted for. Clients receive detailed, professional invoices with full visibility of services rendered.

Wholesale & Distribution

High transaction volume and dynamic pricing make invoicing a challenge for wholesalers. Minasoft allows batch invoicing, flexible payment terms, multi-currency support, and integration with logistics. Automate credit notes for returns, and monitor outstanding receivables in real time.

Field Services & Maintenance

Service teams in the field often need to bill for hours, parts, or emergency calls. With Minasoft, work orders completed in the field convert instantly into invoices. Mobile integration, client signatures, and online payments ensure faster billing cycles and fewer errors.

Education & Training

From monthly tuition to one-time course fees, educational institutions benefit from Minasoft's recurring billing, payment portals, and automated reminders. Parents or students can manage their accounts online, reducing administrative overhead and improving collection rates.